Stock / Mutual / Dividends

There are various ways to categorize insurance companies. One way is by where they are incorporated/headquartered and where they are doing business; domestic, foreign, alien. Another way to categorize insurance companies is by how their ownership is structured. Insurance companies can be structured in one of two ways. Insurance companies are either Stock Companies or Mutual Companies.

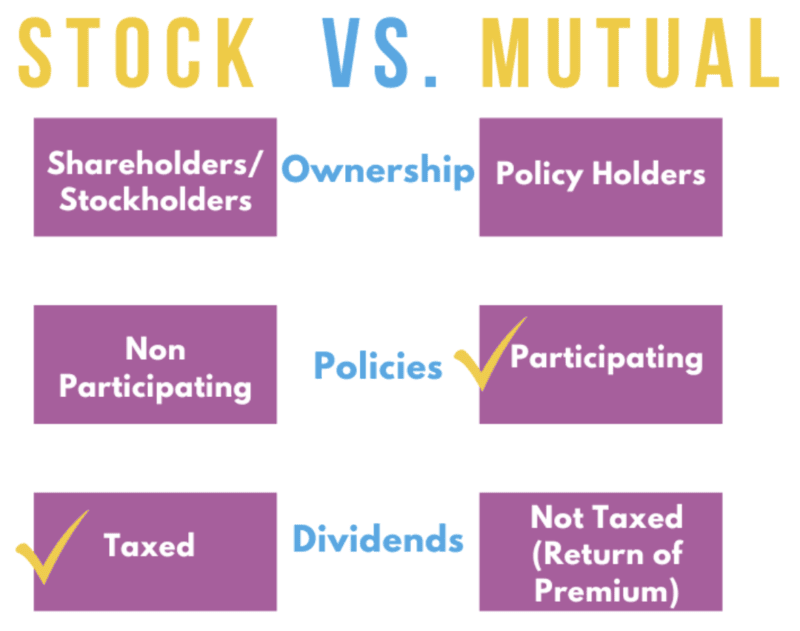

A stock company is owned by Shareholders and it does NOT matter if the shareholder has a policy with the company or not. Thus, we say stock companies issue non-participating policies.

A mutual company is owned by the policyholders. If you have an auto policy with the company, you’re now part of owner of the company. Thus, we call them participating policies.

In the insurance world, insurance companies have excess money when they collect more premium than what they pay out in claims. This excess profit is given to the owners and we call it “dividends”.

In a Mutual company, the money will go BACK the policyholders, because it’s quite literally returning their own premium back to them. Since they are getting their own money back, there are no taxes to be paid on the money the company gives them back.

Now in a stock company, the shareholders never paid a premium, so when they get a dividend check, aka, excess premium, it’s NOT their own money, it’s considered INCOME and they will need to pay taxes on it.

And a big point to remember is, Dividends are NEVER guaranteed. While insurance companies can make predictions about claims, we never know what mother nature will do and there maybe years with a ton of claims, and no profit.

Recommended: Gold

The GOLD Course is ALWAYS the recommended class series for all students as it teaches the material in more depth. Over 30 hours of the most in depth classes with a more intensive teaching of the topic. Learn more about P&C GOLD Learn more about L&H GOLD

Share the Post

Click to share the post to your network